What to Expect From Willis Towers Watson's Q1 2025 Earnings Report

/Willis%20Towers%20Watson%20Public%20Limited%20Co%20phone-by%20viewimage%20by%20Shutterstock.jpg)

London-U.K.-based Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking and solutions company. Its solutions include risk management, benefits optimization and capability expansion. Valued at $31.4 billion by market cap, WTW operates through Risk & Broking, and Health, Wealth & Career segments.

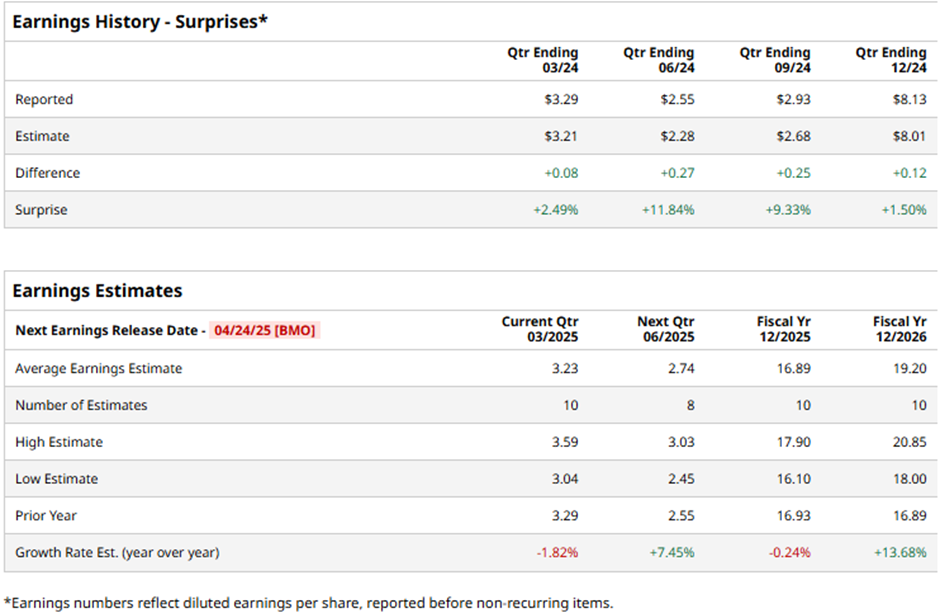

WTW is gearing up to release its first-quarter results before the markets open on Thursday, Apr. 24. Ahead of the event, analysts expect the firm to report a non-GAAP EPS of $3.23, down 1.8% from the year-ago quarter’s earnings of $3.29 per share. On a more positive note, WTW has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect the insurance broker to report a non-GAAP EPS of $16.89, marginally down from $16.93 in fiscal 2024. While in fiscal 2026, its earnings are expected to rebound 13.7% year-over-year to $19.20 per share.

WTW stock has soared more than 20% over the past 52 weeks, significantly outpacing the S&P 500 Index’s ($SPX) 2.1% uptick and the Financial Select Sector SPDR Fund’s (XLF) 12.3% gains during the same time frame.

Willis Towers Watson’s stock dipped 3.1% after the release of its mixed Q4 results on Feb. 4. Driven by solid organic growth, the company’s topline increased 4.2% year-on-year to more than $3 billion, however, this figure fell short of Street’s expectations by a small margin. On the brighter side, due to the reduction in expenses, WTW’s non-GAAP operating margin expanded by 190 bps compared to the year-ago quarter, reaching 36.1%. This led to a solid 9.8% growth in non-GAAP operating profits to $1.1 billion and a 6.7% increase in non-GAAP net income to $827 million. Moreover, its non-GAAP EPS of $8.13 surpassed the consensus estimates by 1.5%.

The consensus opinion on WTW stock is cautiously optimistic, with a “Moderate Buy” rating overall. Out of the 20 analysts covering the stock, 13 recommend “Strong Buy,” one advises “Moderate Buy,” five suggest “Hold,” and one advocates a “Strong Sell” rating. Its mean price target of $363.50 represents a 14.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.