No Bull | The Five Spot

5 | Five weeks

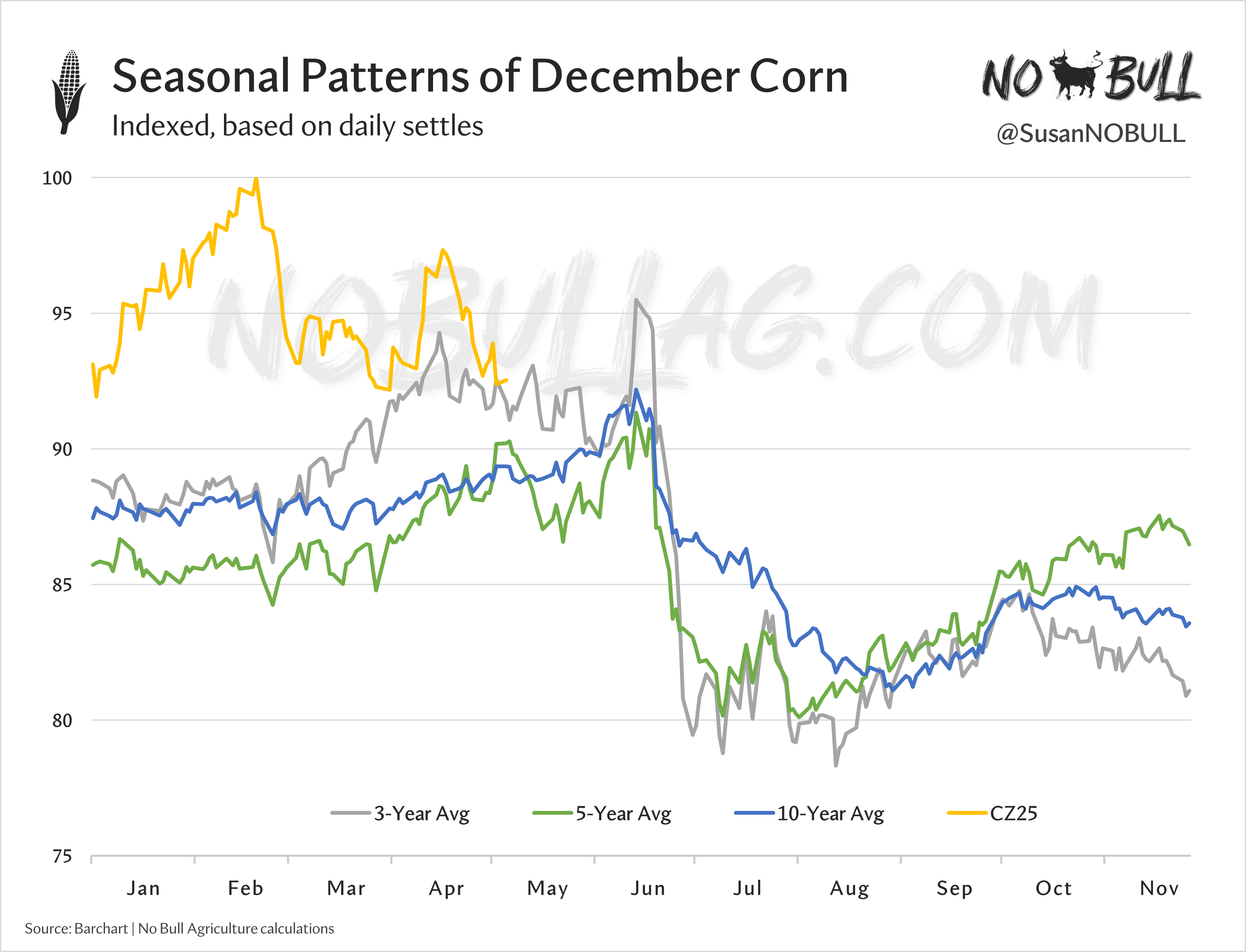

History says we have about five weeks remaining before new crop corn futures fall off a cliff:

4 | A dramatic rise

Brazil’s Safrinha production is the primary driver behind the country’s dramatic rise as a major world corn exporter.

In the last two decades, Brazil’s total corn output has surged from 35mmt (1.38bbu) to over 125mmt (near 5bbu), fueled by a nearly 13-fold expansion of its second season (Safrinha) crop, planted after soybeans are harvested.

3 | How low can you go?

February biomass-based diesel feedstock data was released last week… and it was ugly with crop-based feedstocks reaching multi-year lows amid the market's transition to 45Z.

Total feedstock demand has reached a two-year low of 2.1 billion pounds. Noteworthy declines include:

Soybean oil: 4-year low

Canola oil: 3-year low

Corn oil: 2-year low

2 | Uphill battle

Soybean oil biofuel demand has started calendar year 2025 at multi-year lows, requiring a near-record amount of use each month the remainder of the 2024/25 marketing year to hit USDA's current full-year projection.

Given recent policy changes and ongoing uncertainty, USDA will be forced to reduce biofuel demand in future WASDE's while offsetting some of the losses with upticks in food, feed, and other demand.

1 | Who's #1?

For the past five years (2020-2024), soybeans have been the United States' top export to China. This streak followed a period where soybeans were consistently #2 (behind civilian aircraft) until the 2018 US-China trade war dropped them to #6. Their top ranking was restored as China resumed US soybean imports after Phase One was implemented.

For this reason, soybeans are viewed as a bargaining chip in US-China negotiations, though China has ample supplies alternative South American supplies available.

For the full version of this post or to subscribe, visit NoBullAg.com.

Thanks!