What Are Wall Street Analysts' Target Price for AT&T Stock?

With a market cap of $198.6 billion, AT&T Inc. (T) is one of North America's largest wireless and communications service providers. The Dallas, Texas-based company operates through its Communications and Latin America segments, delivering wireless, broadband, and data services to over 240 million customers, reinforcing its position as a key player in the telecom industry.

Shares of the telecom behemoth have notably outperformed the broader market over the past 52 weeks. T has soared 45% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.6%. Moreover, shares of T are up 20.4% on a YTD basis, compared to SPX’s 8.3% rise.

Zooming in, AT&T has also surpassed the Communication Services Select Sector SPDR ETF Fund's (XLC) 25.7% rise over the past 52 weeks and 4.2% surge on a YTD basis.

On July 23, AT&T reported strong Q2 results, highlighting growth driven by high-quality 5G and fiber subscriber additions. Revenue rose 3.5% year-over-year to $30.8 billion, and adjusted EPS beat expectations at $0.54. The company added 401,000 postpaid wireless subscribers and 243,000 fiber customers, supporting solid service revenue and earnings growth. T shares climbed 1.2% following the earnings release.

For the current fiscal year, ending in December 2025, analysts expect T's adjusted EPS to decline 9.7% year-over-year to $2.04. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

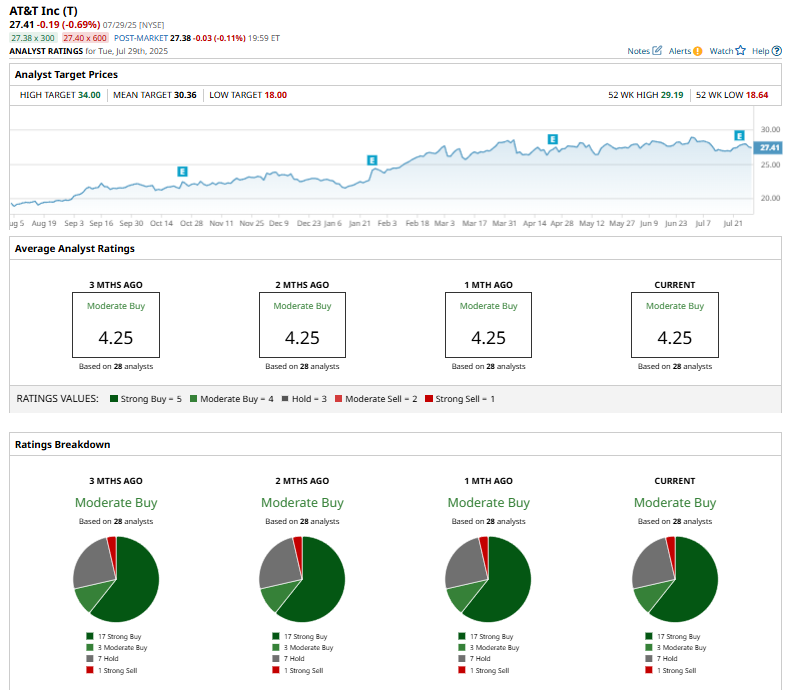

Among the 28 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, three “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

On July 24, Raymond James reaffirmed a "Strong Buy" rating on AT&T and raised its price target from $30 to $31, reflecting continued confidence in the stock’s outlook and a 3.33% increase in projected valuation.

AT&T's mean price target of $30.36 implies a modest 10.8% premium to current price levels, while the Street-high target of $34 suggests a staggering 24% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.