This Dividend Stock Is Shaking on Tariff Threats. How Should You Play Shares Here?

Retail sales rose 0.5% in July as consumers increased their purchases despite growing tariff pressures across the industry. American shoppers now face an average tax of 18.6% on imported goods, the highest level since 1933, following new tariffs that took effect in August 2025.

As input costs continue to climb, discount retailers have come under close watch. On Aug. 28, Dollar General’s (DG) stock dropped 1.32% after its second-quarter earnings report warned of margin pressures caused by tariffs. Even with a notable 9.4% rise in earnings per share, a market capitalization of $23.93 billion, and a steady 2.17% dividend yield, CEO Todd Vasos noted that tariffs have already led to some price increases. This highlights the challenging balance between keeping prices affordable and managing higher import costs.

Recently, tariff exemptions for shipments under $800 were eliminated, adding to the pressure on retailers. At the same time, federal courts have questioned the legality of current tariff policies but have left them in effect for now.

With these developments, Dollar General’s ability to continue paying dividends is facing significant external challenges. Can this steady dividend stock keep rewarding shareholders while dealing with a complex trade environment that could fundamentally change the discount retail sector? Let’s take a closer look.

Dollar General's Recent Financial Metrics

Dollar General is a major discount retailer in the United States, providing a wide range of household essentials, consumables, and seasonal items at affordable prices through its large network of stores.

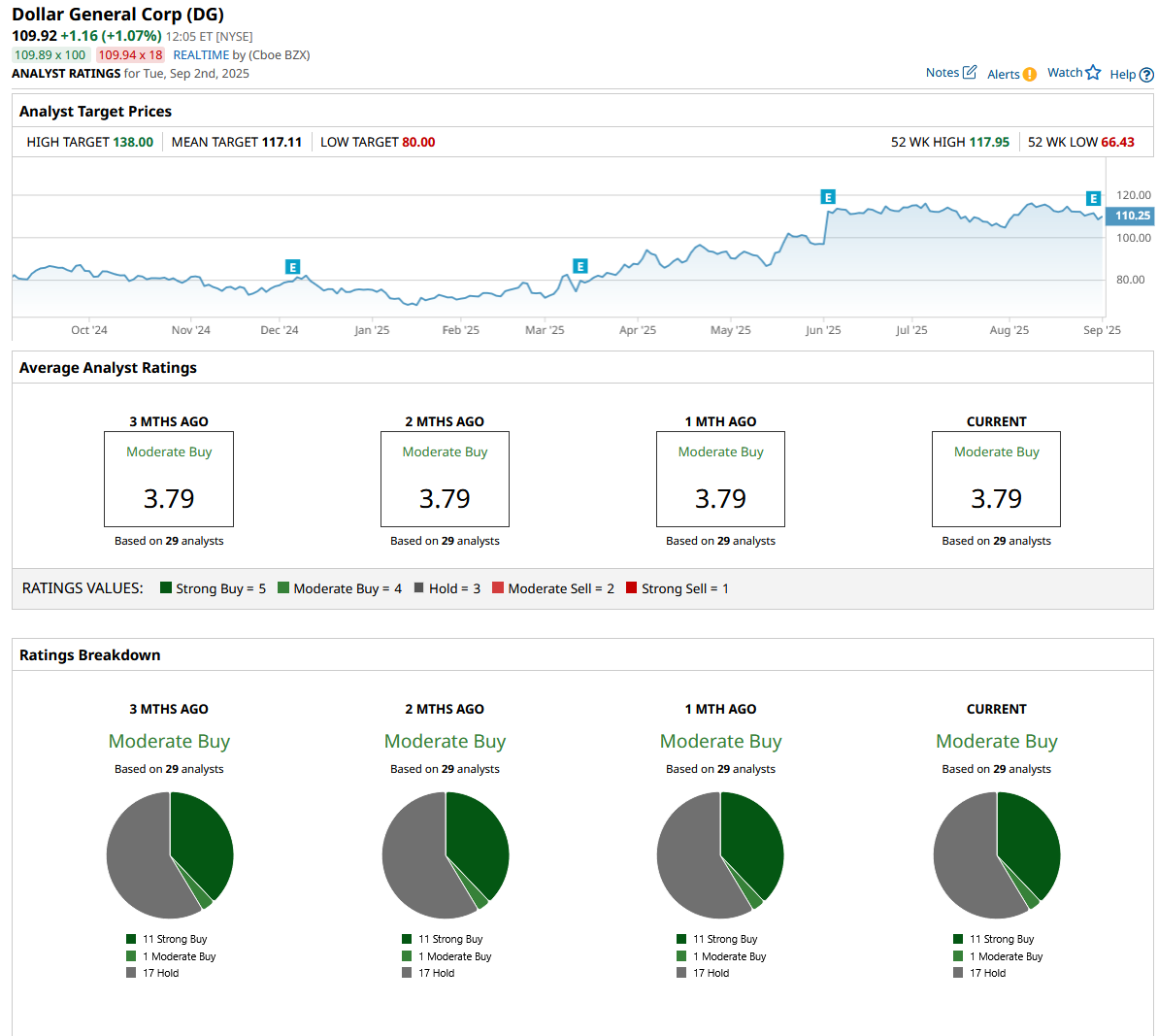

Over the past year, DG stock has seen some ups and downs, hitting its 52-week low of $66.43 in January, but is now up 33% over the last 52 weeks and has shown even stronger recovery with a year-to-date (YTD) gain of 46%.

Looking at valuation, the stock currently trades with a forward price-to-earnings (P/E) ratio of around 17.97x. This is above the sector average of 16.54x, suggesting that investors remain confident in the company’s growth prospects despite some risks.

On the financial side, Dollar General delivered solid results in the second quarter of 2025. Net sales rose 5.1%, reaching $10.7 billion. This growth was driven by new store openings and a 2.8% increase in same-store sales. The increase was seen across several categories, including consumables, seasonal items, home products, and apparel.

Operating profit went up 8.3% to $595.4 million, helped by stronger gross margins, which improved by 137 basis points to 31.3%. This margin boost came from lower shrinkage and better inventory management, even though distribution costs and markdowns rose. Net income increased 10% to $411.4 million, pushing diluted earnings per share up 9.4% to $1.86. Cash flow from operations also grew nearly 10% YTD, reaching $1.8 billion, putting Dollar General in a strong position to keep investing in new stores and renovations.

Growth Drivers Amid Tariff Pressures

Dollar General has teamed up with Uber (UBER) Eats to deliver essentials from more than 14,000 Dollar General and pOpshelf stores across the country. This partnership aims to meet the growing demand for fast and affordable delivery, expanding Dollar General’s reach beyond its physical stores. It could help boost sales and keep customers engaged while managing costs effectively.

On another front, Dollar General’s collaboration with NationsBenefits brings new healthcare fintech solutions to over 20,000 locations. With the Basket Analyzer Service, millions of health plan members get easier access to affordable, nutritious food and wellness products. This move not only makes Dollar General more appealing to health-focused and budget-conscious shoppers but also may lead to bigger purchases and stronger customer loyalty.

Supporting these growth efforts are Dollar General’s ongoing real estate projects for 2025. The company plans to open about 575 new stores in the U.S., up to 15 stores in Mexico, and remodel thousands more through its Projects Renovate and Elevate programs. These initiatives help expand Dollar General’s footprint and update its existing stores, which is key to keeping traffic and sales strong despite rising costs linked to tariffs.

These combined drivers help Dollar General maintain its dividend payments. The stock currently offers a yield of 2.17%, which is higher than the 1.89% average for consumer staples. The company’s board recently announced a quarterly dividend of $0.59 per share, keeping dividends steady. With a payout ratio just under 39%, the dividend is well supported by earnings, reflecting Dollar General’s healthy cash flow.

Analyst Insights and Forward Projections

Dollar General’s outlook looks solid as the company has raised its financial guidance for fiscal 2025. It now expects net sales to grow between 4.3% and 4.8%, up from its earlier forecast of 3.7% to 4.7%. Earnings per share forecasts have been increased too, with expectations now ranging from $5.80 to $6.30, improving on the earlier $5.20 to $5.80 range.

Analysts have reacted with cautious optimism. Joseph Feldman from Telsey Advisory Group raised his price target from $120 to $123 while keeping a “Market Perform” rating. He points to gains across all income groups as consumers look for value, along with the company’s progress on strategic initiatives and strong execution in a challenging economic environment.

Similarly, Goldman Sachs analyst Kash Rangan lifted his price target from $116 to $126 but maintained a “Neutral” rating, highlighting the success of Dollar General’s "Back to Basics" program, which has led to better comparable store sales and improved profit margins.

Overall, the analyst community shares this positive view. All 29 surveyed analysts give the stock a consensus “Moderate Buy” rating. Their average price target of $117.11 suggests about a 7% upside from the current share price.

Conclusion

Despite the tariff pressures rattling the market and triggering a sharp reaction to Dollar General’s recent earnings, the company’s solid financial performance, strategic growth initiatives, and strong analyst support suggest it remains a resilient dividend stock. While tariffs pose ongoing cost challenges, Dollar General’s ability to innovate through partnerships and expand its footprint positions it to navigate this tricky environment effectively. Given the optimistic guidance and moderate analyst upside, shares are likely to stabilize and show modest gains, making DG a compelling play for investors focused on steady income and long-term growth amid uncertainty.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.